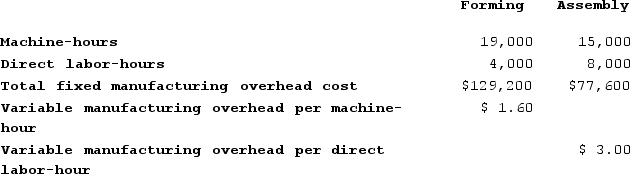

Deloria Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T288. The following data were recorded for this job:

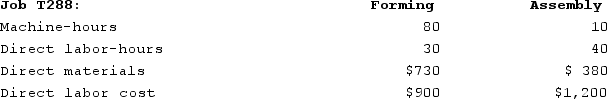

During the current month the company started and finished Job T288. The following data were recorded for this job: The estimated total manufacturing overhead for the Assembly Department is closest to:

The estimated total manufacturing overhead for the Assembly Department is closest to:

Definitions:

Agency Costs

Expenses related to resolving conflicts of interest between company managers and shareholders.

Employee Empowerment

The delegation of greater decision rights to members of the organization.

Decision Rights

The rights or authority to make decisions within an organization, often delineated by roles or levels within the organizational structure.

Transactions Costs

Expenses incurred when buying or selling goods or services, including search, bargaining, and enforcement costs.

Q6: On November 1, Arvelo Corporation had $32,000

Q36: If a company uses a predetermined overhead

Q38: Hickingbottom Corporation has two production departments, Forming

Q45: Kostelnik Corporation uses a job-order costing system

Q181: Prayer Corporation has two production departments, Machining

Q226: Bullie Manufacturing Corporation has a traditional costing

Q267: Advertising costs should NOT be charged to

Q288: The journal entry for cost of goods

Q307: The variable cost per unit depends on

Q380: Dallman Corporation uses a job-order costing system