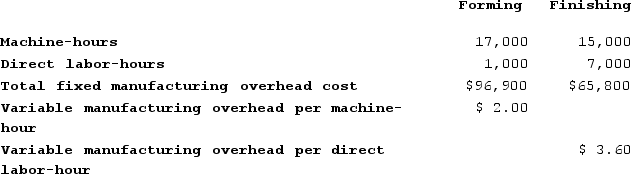

Hickingbottom Corporation has two production departments, Forming and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job M381. The following data were recorded for this job:

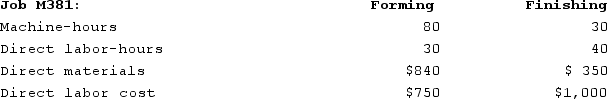

During the current month the company started and finished Job M381. The following data were recorded for this job: The total job cost for Job M381 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job M381 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Vertically Integrated

A company structure where the company controls multiple stages of production, distribution, or both within the same industry.

Entire Value Chain

The full range of activities involved in designing, producing, marketing, and selling a product or service, from initial concept to delivery to the end user.

Variable Selling

Costs associated with selling that vary directly with the level of sales activity.

Administrative Costs

Administrative costs are expenses related to the general operations of a business, including salaries of office staff, utilities, and rent.

Q4: Kostelnik Corporation uses a job-order costing system

Q95: Easterling Corporation uses a job-order costing system.

Q96: Wessendorf Corporation uses a job-order costing system

Q209: Bressette Corporation has provided the following information:

Q231: Selling costs are indirect costs.

Q240: Most companies use the contribution approach in

Q277: Which costs will change with a decrease

Q287: Merati Corporation has two manufacturing departments--Forming and

Q341: Madole Corporation has two production departments, Forming

Q387: Look Manufacturing Corporation has a traditional costing