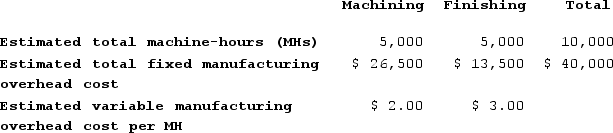

Sanderlin Corporation has two manufacturing departments--Machining and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job C and Job L. There were no beginning inventories. Data concerning those two jobs follow:

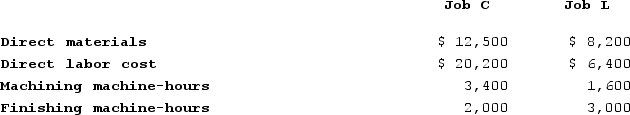

During the most recent month, the company started and completed two jobs--Job C and Job L. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 20% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Q2: Bolander Corporation uses a job-order costing system

Q12: Tevebaugh Corporation is a manufacturer that uses

Q26: An income statement for Sam's Bookstore for

Q28: The following costs were incurred in May:

Q72: Mark is an engineer who has designed

Q146: Harnett Corporation has two manufacturing departments--Molding and

Q200: Tyare Corporation had the following inventory balances

Q270: On December 1, Mogro Corporation had $26,000

Q302: Eisentrout Corporation has two production departments, Machining

Q329: The University Store,Incorporated is the major bookseller