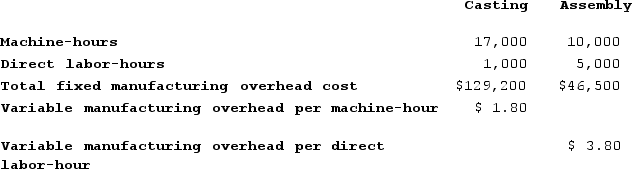

Tiff Corporation has two production departments, Casting and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job P131. The following data were recorded for this job:

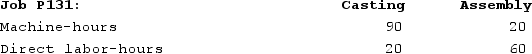

During the current month the company started and finished Job P131. The following data were recorded for this job: The amount of overhead applied in the Assembly Department to Job P131 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Assembly Department to Job P131 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Capital Account Balances

Reflects the total amount of capital a member or shareholder has contributed or accumulated within a company.

Noncash Assets

Assets owned by a business that are not in the form of cash but can be converted into cash within a year, including inventory, real estate, and investments.

Safe Cash Payments

Transactions made in cash that are secure and minimize the risk of theft or loss.

Liquidation Expenses

Costs associated with winding up a company's operations, selling off assets, and paying off creditors in the event of liquidation or bankruptcy.

Q5: Gabel Incorporated is a merchandising company. Last

Q31: A factory supervisor's wages are classified as:

Q78: Daget Corporation uses direct labor-hours in its

Q196: Vogel Corporation's cost of goods manufactured last

Q199: Weatherhead Incorporated has provided the following data

Q235: Tirri Corporation has provided the following information:

Q326: Landmann Corporation's relevant range of activity is

Q366: Deloria Corporation has two production departments, Forming

Q385: Alsobrooks Corporation uses a job-order costing system

Q389: Sanderlin Corporation has two manufacturing departments--Machining and