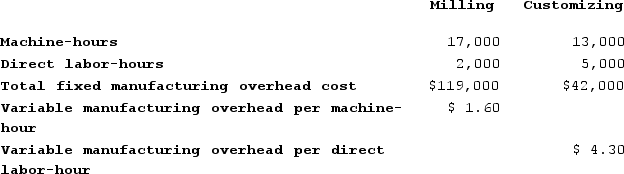

Barbeau Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A492. The following data were recorded for this job:

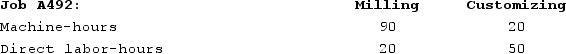

During the current month the company started and finished Job A492. The following data were recorded for this job: The amount of overhead applied in the Milling Department to Job A492 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Milling Department to Job A492 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Gastrocnemius Muscle

A major muscle located at the back part of the lower leg, contributing to plantar flexion (pointing the toes) and knee flexion, playing a crucial role in walking, running, and jumping.

Dorsiflexion

The action of raising the foot upwards towards the shin, decreasing the angle between the dorsum (top) of the foot and the leg.

Psoas Major

A large skeletal muscle that runs from the lumbar region of the vertebral column to the femur and is involved in flexing the hip joint and bending the spine.

Iliopsoas

The iliopsoas is a major muscle group consisting of the iliacus and psoas major muscles, important for flexing the hip.

Q6: Depreciation on equipment a company uses in

Q6: On November 1, Arvelo Corporation had $32,000

Q32: Wessner Corporation has provided the following information:

Q101: Marioni Corporation has two manufacturing departments--Forming and

Q112: Adens Corporation's relevant range of activity is

Q158: As the level of activity increases, how

Q167: Grib Corporation uses a predetermined overhead rate

Q233: Crich Corporation uses direct labor-hours in its

Q258: Acheson Corporation, which applies manufacturing overhead on

Q280: Darrow Corporation uses a predetermined overhead rate