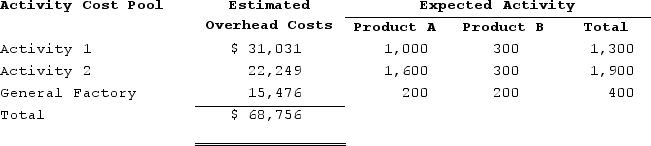

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:  (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The overhead cost per unit of Product B under the traditional costing system is closest to:

Definitions:

Sample Means

The average value of a set of sample data, used to estimate the population mean.

Standard Deviation

An index of how much individual observations of a dataset vary from the dataset's mean.

Lower Control Limit

The lowest boundary of acceptable performance in a statistical quality control chart, below which a process is considered out of control.

Assignable Causes

Specific, identifiable factors leading to variations in a process or system, as opposed to random variations.

Q10: An income statement for Sam's Bookstore for

Q24: Gilchrist Corporation bases its predetermined overhead rate

Q64: Within the relevant range, a change in

Q186: Adelberg Corporation makes two products: Product A

Q192: Bledsoe Corporation has provided the following data

Q222: Mccaughan Corporation bases its predetermined overhead rate

Q252: The accounting records of Omar Corporation contained

Q259: Lezo Corporation uses a job-order costing system

Q300: Njombe Corporation manufactures a variety of products.

Q326: Risser Woodworking Corporation produces fine cabinets. The