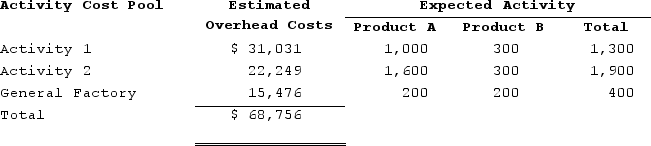

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:  (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The predetermined overhead rate (i.e., activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Job-order Costing

A cost accounting system that accumulates manufacturing costs separately for each job.

Direct Labour Cost

The wages and benefits paid to employees who are directly involved in the production of goods or services.

Manufacturing Overhead Applied

The portion of estimated manufacturing overhead costs that is assigned to each unit of production, based on a predetermined rate.

Job-order Costing

An accounting method that tracks costs individually for each job, rather than within set periods.

Q6: Depreciation on equipment a company uses in

Q21: Caple Corporation applies manufacturing overhead on the

Q54: Dehner Corporation uses a job-order costing system

Q96: Management of Plascencia Corporation is considering whether

Q110: Carcana Corporation has two manufacturing departments--Machining and

Q165: If the acid-test ratio is less than

Q187: Able Corporation uses a job-order costing system.

Q251: Norred Corporation has provided the following information:

Q258: Njombe Corporation manufactures a variety of products.

Q266: Although the traditional format income statement is