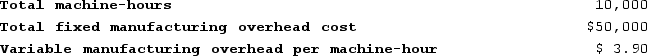

Thrall Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

Recently Job K125 was completed and required 160 machine-hours.Required:Calculate the amount of overhead applied to Job K125.

Recently Job K125 was completed and required 160 machine-hours.Required:Calculate the amount of overhead applied to Job K125.

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, demonstrating the percentage of tax applied to your income for each tax bracket in which you qualify.

Taxable Income

The income subject to taxes after deductions and exemptions.

Price Elasticity

The calculation of how price alterations affect the demand level of a good.

Excise Tax

A specific type of tax levied on particular goods, services, or transactions, often included in the price of items such as gasoline, alcohol, and tobacco.

Q30: At an activity level of 9,000 machine-hours

Q60: Niles Corporation is a manufacturer that uses

Q67: The following partially completed T-accounts summarize transactions

Q88: Bierce Corporation has two manufacturing departments--Machining and

Q177: Dizzy Amusement Park is open from 8:00

Q192: Lupo Corporation uses a job-order costing system

Q204: The Tse Manufacturing Corporation uses a job-order

Q265: Mausser Woodworking Corporation produces fine cabinets. The

Q274: Schwiesow Corporation has provided the following information:

Q297: Glew Corporation has provided the following information: