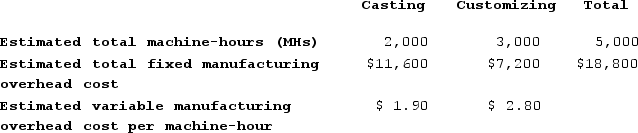

Luarca Corporation has two manufacturing departments--Casting and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

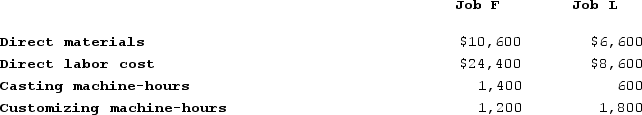

During the most recent month, the company started and completed two jobs--Job F and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job F and Job L. There were no beginning inventories. Data concerning those two jobs follow:

Required:Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 50% on manufacturing cost to establish selling prices. Calculate the selling prices for Job F and Job L.

Required:Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 50% on manufacturing cost to establish selling prices. Calculate the selling prices for Job F and Job L.

Definitions:

Capital Structure

Refers to the blend of debt, equity, and other financing sources used by a company to fund its operations and growth endeavors.

Retained Earnings

The portion of net earnings not paid out as dividends but retained by the company to reinvest in its core business or to pay debt.

Depreciation Expense

A method for allocating the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Flotation Costs

The costs incurred by a company when it issues new securities, including underwriting fees, legal fees, and registration fees.

Q11: Schwiesow Corporation has provided the following information:

Q70: Factory overhead is typically a(n):<br>A) mixed cost.<br>B)

Q96: Management of Plascencia Corporation is considering whether

Q142: Franta Corporation uses a job-order costing system

Q166: At an activity level of 9,300 machine-hours

Q188: Giannitti Corporation bases its predetermined overhead rate

Q231: Kalp Corporation has two production departments, Machining

Q320: The management of Bullinger Corporation would like

Q345: Committed fixed costs represent organizational investments with

Q384: Coble Woodworking Corporation produces fine cabinets. The