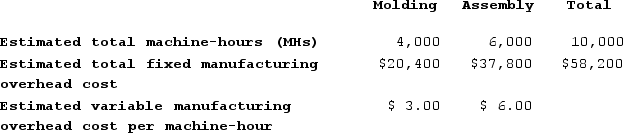

Harnett Corporation has two manufacturing departments--Molding and Assembly. The company used the following data at the beginning of the period to calculate predetermined overhead rates:

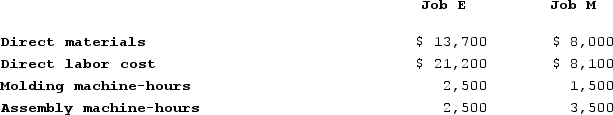

During the period, the company started and completed two jobs--Job E and Job M. Data concerning those two jobs follow:

During the period, the company started and completed two jobs--Job E and Job M. Data concerning those two jobs follow:

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job E. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job E. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job E. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Molding department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Assembly department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job E? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job E. (Do not round intermediate calculations.)

Required:a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2 decimal places.)b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job E. (Do not round intermediate calculations.)c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job E. (Do not round intermediate calculations.)d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job E. (Do not round intermediate calculations.) e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined overhead rate in the Molding department? (Round your answer to 2 decimal places.)f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. What is the departmental predetermined overhead rate in the Assembly department? (Round your answer to 2 decimal places.)g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job E? (Do not round intermediate calculations.)h. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 80% on manufacturing cost to establish selling prices. Calculate the selling price for Job E. (Do not round intermediate calculations.)

Definitions:

Price Floor

A government or regulatory-imposed minimum price below which a good or service cannot legally be sold, intended to protect producers.

Binding Price Floor

A government-imposed price control that sets a minimum price for a good or service, which is above the equilibrium price, causing a surplus.

Excess Supply

A situation in a market where the quantity of a product offered for sale by producers exceeds the quantity demanded by consumers at a current price, leading to potential downward pressure on prices.

Market Outcome

The result of interactions between buyers and sellers in a market that determines the quantity sold and the price at which it sells.

Q110: Natcher Corporation's accounts receivable at the end

Q123: Thach Corporation uses a job-order costing system

Q136: Amunrud Corporation uses a job-order costing system

Q145: Differential costs can only be variable.

Q170: Dake Corporation's relevant range of activity is

Q213: Stoke Corporation has two production departments, Forming

Q233: Data from Fontecchio Corporation's most recent balance

Q271: Sefcovic Enterprises LLC recorded the following transactions

Q338: Lupo Corporation uses a job-order costing system

Q342: Krier Corporation uses a predetermined overhead rate