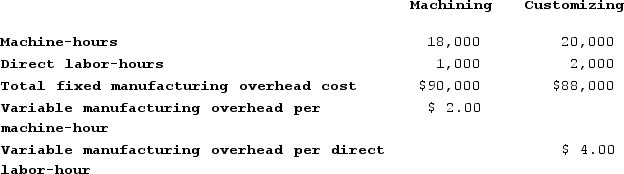

Bulla Corporation has two production departments, Machining and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

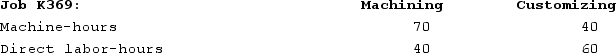

During the current month the company started and finished Job K369. The following data were recorded for this job:

During the current month the company started and finished Job K369. The following data were recorded for this job:

Required:Calculate the total amount of overhead applied to Job K369 in both departments. (Do not round intermediate calculations.)

Required:Calculate the total amount of overhead applied to Job K369 in both departments. (Do not round intermediate calculations.)

Definitions:

Tangible Costs

Explicit expenses or outlays that are easily quantifiable and often involve monetary transactions, such as equipment purchases, rent, and salaries.

Intangible Costs

Expenses or costs that are not easily quantifiable, including things like brand value, intellectual property, or goodwill.

Variable Costs

Costs that change in direct proportion to sales.

Price Elastic

Refers to how sensitive the demand for a product is to changes in its price; high elasticity indicates demand significantly changes with price adjustments.

Q11: The management of Wrights Corporation would like

Q54: A step-variable cost is a cost that

Q77: Garza Corporation has two production departments, Casting

Q125: Hardigree Corporation uses a job-order costing system.

Q139: Marquess Corporation has provided the following partial

Q164: Reamer Corporation uses a predetermined overhead rate

Q304: Rocher Corporation has two production departments, Casting

Q347: Hultquist Corporation has two manufacturing departments--Forming and

Q392: The management of Schneiter Corporation would like

Q404: The management of Michaeli Corporation would like