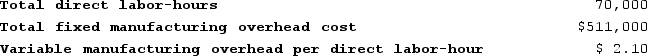

Session Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job K913 was completed with the following characteristics:

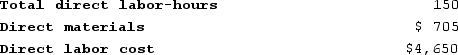

Recently, Job K913 was completed with the following characteristics: The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Zero-Coupon Bond

A debt security that does not pay interest (coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its face value.

Yield to Maturity

The total return anticipated on a bond if held until it matures, considering all payments of interest and principal and the time value of money.

Par Value

The face value of a bond or stock, typically the value printed on the certificate, which does not necessarily reflect its market value.

Treasury Bond

Long-term government debt securities issued by the U.S. Department of the Treasury, with maturity periods typically ranging from 20 to 30 years, considered low-risk investments.

Q3: Rist Corporation uses a predetermined overhead rate

Q61: Parker Corporation has a job-order costing system

Q64: Halbur Corporation has two manufacturing departments--Machining and

Q108: The Tse Manufacturing Corporation uses a job-order

Q109: Dehner Corporation uses a job-order costing system

Q215: Vasilopoulos Corporation has two production departments, Casting

Q273: Angeloni Corporation uses a job-order costing system

Q301: Rapier Woodworking Corporation produces fine cabinets. The

Q366: Deloria Corporation has two production departments, Forming

Q405: Dunnings Woodworking Corporation produces fine cabinets. The