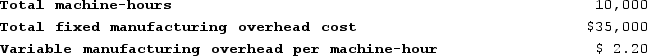

Sutter Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T369 was completed with the following characteristics:

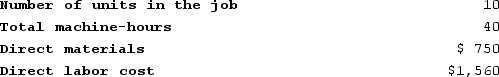

Recently, Job T369 was completed with the following characteristics: If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

National Income

The total income earned by a country's residents and businesses, including wages, profits, and investment earnings, usually measured within a specific time period.

Transfer Payments

Payments made by governments to individuals through social benefit programs without any goods or services being received in return.

Real Return

The profit or income generated by an investment, adjusted for inflation, representing the true increase in purchasing power.

Q23: Kroeker Corporation has two production departments, Milling

Q86: The following data pertains to activity and

Q147: Overly Corporation uses a job-order costing system

Q160: Morataya Corporation has two manufacturing departments--Machining and

Q173: Bledsoe Corporation has provided the following data

Q235: Tirri Corporation has provided the following information:

Q325: The relevant range concept is applicable to

Q327: Strzelecki Corporation uses the step-down method to

Q365: Prestwich Corporation has two service departments and

Q377: Lupo Corporation uses a job-order costing system