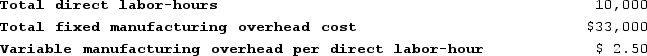

Decorte Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job K332 was completed with the following characteristics:

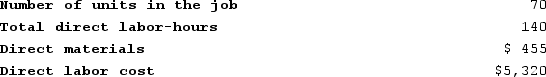

Recently, Job K332 was completed with the following characteristics: The unit product cost for Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

IQR

The interquartile range (IQR) is a measure of statistical dispersion, representing the difference between the 75th (upper quartile) and 25th (lower quartile) percentiles of a data set.

Median

The median is the central number in a sequence of values, dividing the higher half and the lower half of the data set.

Real Estate

Property consisting of land and the buildings on it, along with its natural resources, such as crops, minerals, or water; immovable property of this nature.

Apartments

Residential units in a building or complex, typically owned or rented as homes.

Q9: Blasi Corporation is a manufacturer that uses

Q11: If the actual manufacturing overhead cost for

Q16: Hutchcroft Corporation uses the weighted-average method in

Q50: Kavin Corporation uses a predetermined overhead rate

Q120: Giannitti Corporation bases its predetermined overhead rate

Q121: Barbeau Corporation has two production departments, Milling

Q151: Beans Corporation uses a job-order costing system

Q181: Two of the reasons why manufacturing overhead

Q258: Acheson Corporation, which applies manufacturing overhead on

Q294: Firebaugh Corporation is a manufacturer that uses