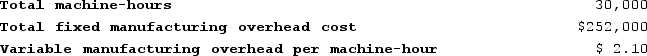

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

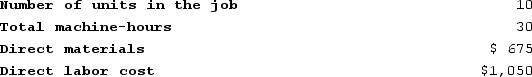

Recently, Job T687 was completed with the following characteristics: The unit product cost for Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Basic Earnings Per Share

A measure of a company's profitability on a per-share basis, calculated by dividing net income by the average number of shares outstanding.

Common Shares

Equity securities that represent ownership in a corporation, typically with voting rights and potential dividends.

IFRS

International Financial Reporting Standards, a set of accounting standards that guide companies in preparing financial statements globally.

Other Comprehensive Income

Other Comprehensive Income includes revenues, expenses, gains, and losses that are not included in net income, affecting the equity section of the balance sheet.

Q59: Forbes Corporation uses a predetermined overhead rate

Q82: Fixed costs expressed on a per unit

Q83: The fact that one department may be

Q132: Wears Corporation uses a job-order costing system

Q142: Refer to the T-account below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8314/.jpg"

Q184: Baka Corporation applies manufacturing overhead on the

Q195: Pine Publishing Corporation uses a predetermined overhead

Q231: On November 1, Arvelo Corporation had $32,000

Q267: Eisentrout Corporation has two production departments, Machining

Q329: The management of Plitt Corporation would like