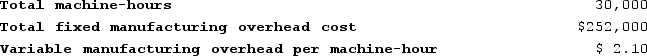

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

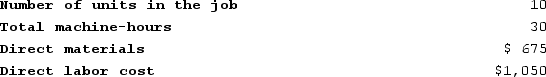

Recently, Job T687 was completed with the following characteristics: If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Purchase Price

The amount of money paid to buy a good or service.

Parking Lot Lighting

Illumination for outdoor parking areas designed to improve safety, security, and the visibility of vehicles and pedestrians.

Land Improvements

Enhancements to a piece of land to increase its value or usability, such as landscaping, fencing, and adding utilities, which are subject to depreciation.

Useful Life

The estimated period over which an asset is expected to be used by an entity before it is replaced or becomes obsolete.

Q14: During March, Zea Incorporated transferred $55,000 from

Q16: During December, Moulding Corporation incurred $87,000 of

Q62: Boursaw Corporation has provided the following data

Q105: Janicki Corporation has two manufacturing departments--Machining and

Q167: Entry (4) in the T-account below represents

Q199: Morataya Corporation has two manufacturing departments--Machining and

Q204: Indirect costs, such as manufacturing overhead, are

Q228: Luebke Incorporated has provided the following data

Q308: Dake Corporation's relevant range of activity is

Q346: Barredo Corporation's relevant range of activity is