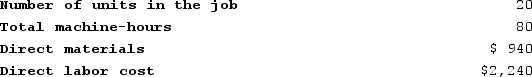

Cull Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $462,000, variable manufacturing overhead of $2.20 per machine-hour, and 60,000 machine-hours. The company has provided the following data concerning Job X455 which was recently completed:  The total job cost for Job X455 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job X455 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Copyright Protection

Legal rights granted to creators and authors over their original works, preventing unauthorized reproduction or use for a limited time.

Fair Use

A legal doctrine allowing limited use of copyrighted material without needing permission, typically for purposes such as criticism, comment, news reporting, or research.

Double-Declining-Balance

A method of accelerated depreciation where an asset's value decreases at double the rate of traditional straight-line depreciation.

Book Value

The original cost of an asset minus accumulated depreciation.

Q15: Which of the following is the correct

Q150: Which of the following statements is true

Q216: Poma Manufacturing Corporation has a traditional costing

Q241: Zackery Woodworking Corporation produces fine cabinets. The

Q248: The management of Holdaway Corporation would like

Q281: Fassino Corporation reported the following data for

Q323: The Silver Corporation uses a predetermined overhead

Q335: Njombe Corporation manufactures a variety of products.

Q351: Coble Woodworking Corporation produces fine cabinets. The

Q390: Lightner Corporation bases its predetermined overhead rate