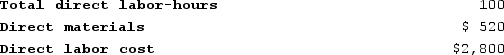

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:  The total job cost for Job A477 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job A477 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Future Expansion

Planning and preparing for growth in business operations, often involving strategic investments in facilities, technology, or workforce.

Intangible Assets

Assets that lack physical substance but have value due to the rights and advantages they provide to the business, such as patents, copyrights, and trademarks.

Uncertain Benefits

Advantages or gains that are not guaranteed or clearly defined, often associated with investments or business ventures.

Physical Form

Refers to the tangible structure or configuration of an object, particularly indicating its real, material state as opposed to a digital or conceptual form.

Q3: Kesterson Corporation has provided the following information:

Q44: Tevebaugh Corporation is a manufacturer that uses

Q57: Tiff Corporation has two production departments, Casting

Q58: The management of Plitt Corporation would like

Q65: Chavez Corporation reported the following data for

Q168: In a traditional format income statement, the

Q174: Parker Corporation has a job-order costing system

Q231: Kalp Corporation has two production departments, Machining

Q256: Odonnel Corporation uses a job-order costing system

Q295: The following accounts are from last year's