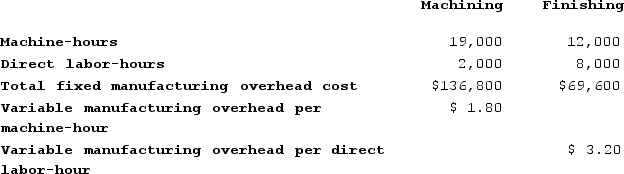

Kalp Corporation has two production departments, Machining and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job K928. The following data were recorded for this job:

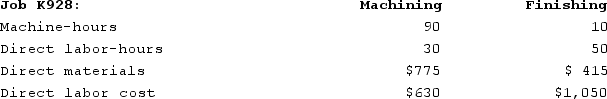

During the current month the company started and finished Job K928. The following data were recorded for this job: The predetermined overhead rate for the Machining Department is closest to:

The predetermined overhead rate for the Machining Department is closest to:

Definitions:

Income

Money received, especially on a regular basis, for work, through investments, or from benefits, that may be subject to taxes.

Services

Economic activities that result in intangible benefits or outputs, such as consulting, banking, or repair work.

Property

Assets owned by a person or a company, encompassing both physical objects and intellectual property.

Life Insurance Proceeds

The money paid to the beneficiaries of a life insurance policy when the insured person passes away.

Q11: If the actual manufacturing overhead cost for

Q11: The management of Wrights Corporation would like

Q14: During March, Zea Incorporated transferred $55,000 from

Q68: Committed fixed costs remain largely unchanged in

Q68: Baab Corporation is a manufacturing firm that

Q83: Pedregon Corporation has provided the following information:

Q84: Lotz Corporation has two manufacturing departments--Casting and

Q243: Nielsen Corporation has two manufacturing departments--Machining and

Q251: Norred Corporation has provided the following information:

Q263: Amason Corporation has two production departments, Forming