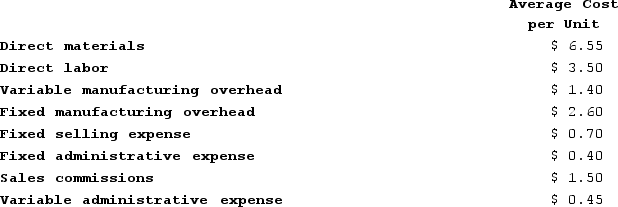

Dake Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  If 3,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

If 3,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

Definitions:

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), reflecting the percentage of income paid in taxes.

Taxable Income

The amount of income that is used to calculate an individual's or a company's income tax due to the government.

Average Tax Rate

The fraction of total income that goes to taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Interest Income

The income earned by an entity from its investments in interest-bearing financial assets such as bonds, loans, or savings accounts.

Q45: Kostelnik Corporation uses a job-order costing system

Q73: Schonhardt Corporation's relevant range of activity is

Q104: Collini Corporation has two production departments, Machining

Q113: Rapier Woodworking Corporation produces fine cabinets. The

Q158: Symons Corporation has provided the following financial

Q185: Fanelli Corporation, a merchandising company, reported the

Q219: Ronson Corporation has two manufacturing departments--Casting and

Q278: Job 243 was recently completed. The following

Q292: Which of the following is correct concerning

Q300: Asplund Corporation has provided the following information:<br>