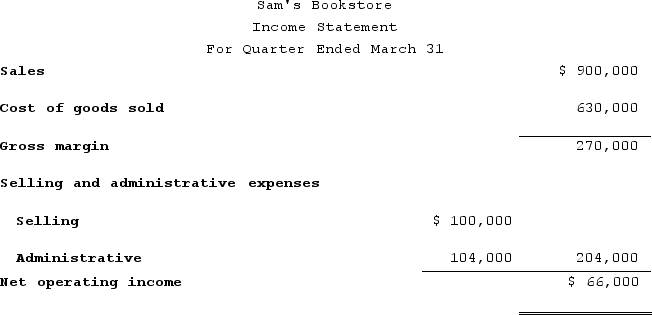

An income statement for Sam's Bookstore for the first quarter of the year is presented below:  On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.The net operating income using the contribution approach for the first quarter is:

On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.The net operating income using the contribution approach for the first quarter is:

Definitions:

Yield To Maturity

The total return anticipated on a bond if held until it matures, including all interest payments and the repayment of principal.

Bond's Value

The present worth of a bond's future interest payments and its repayment of principal at maturity, adjusted for current market interest rates.

9-Year Duration

A metric indicating the sensitivity of a bond's price to changes in interest rates, represented here as the bond having an average response over a nine-year period.

Default Risks

The likelihood that a borrower will fail to meet the obligations of paying back a loan or interest payments.

Q32: The management of Bullinger Corporation would like

Q49: Management of Mcgibboney Corporation has asked your

Q88: Bierce Corporation has two manufacturing departments--Machining and

Q97: As activity decreases within the relevant range,

Q111: The management of Winterroth Corporation would like

Q175: Carriveau Corporation's most recent balance sheet appears

Q206: Trevigne Corporation uses a predetermined overhead rate

Q209: Dahn Corporation has provided the following financial

Q262: Which one of the following statements about

Q305: Financial statements for Narstad Corporation appear below: