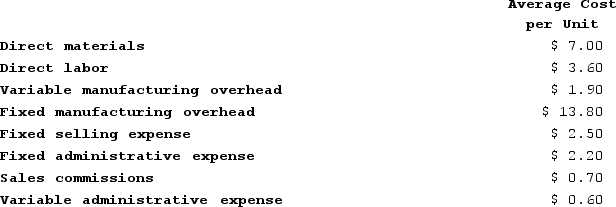

Balerio Corporation's relevant range of activity is 6,000 units to 11,000 units. When it produces and sells 8,000 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 8,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.60 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 8,000 to 8,001 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 8,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.60 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 8,000 to 8,001 units? (Round "Per unit" answer to 2 decimal places.)

Definitions:

Q47: Spackel Corporation recorded the following events last

Q48: Saxon Corporation uses a job-order costing system

Q104: Dake Corporation's relevant range of activity is

Q159: Leas Corporation staffs a helpline to answer

Q187: At an activity level of 6,800 units,

Q247: Which of the following would most likely

Q270: Wegener Corporation's most recent balance sheet and

Q309: Bolka Corporation, a merchandising company, reported the

Q313: Oerther Corporation reports that at an activity

Q324: The Seabury Corporation has a current ratio