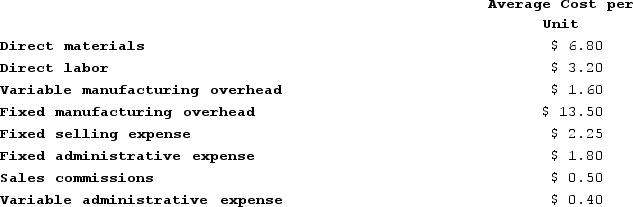

Balerio Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Definitions:

Q6: Alcoser Corporation's most recent balance sheet appears

Q29: The costs of direct materials are classified

Q46: M. K. Berry is the managing director

Q71: If accounts receivable increase during a period,

Q75: Excerpts from Candle Corporation's most recent balance

Q77: Garza Corporation has two production departments, Casting

Q82: The gross margin percentage is computed by

Q125: In a traditional format income statement for

Q165: If the acid-test ratio is less than

Q173: Kearin Corporation has provided the following financial