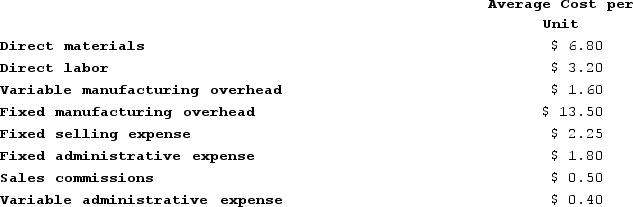

Balerio Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units? (Do not round intermediate calculations.)b. If 10,000 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold? (Do not round intermediate calculations. Round "Per unit" answer to 2 decimal places.)d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units? (Round "Per unit" answer to 2 decimal places.)

Definitions:

Classification System

An organized method for categorizing and systematizing objects or information based on established criteria.

Job Evaluation

A systematic process used to assess the relative value of jobs within an organization, for the purpose of establishing fair compensation.

Private Pension Plans

Retirement plans funded and maintained by private sector employers, providing employees with a fixed or variable pension payment upon retirement, separate from government pension schemes.

Pension Plans

Retirement plans sponsored by employers that provide a fixed income to employees after retirement.

Q34: Petty Corporation has two production departments, Milling

Q57: Abburi Company's manufacturing overhead is 55% of

Q69: Coudriet Manufacturing Corporation has a traditional costing

Q100: Megan Corporation's net income last year was

Q109: Depreciation on a personal computer used in

Q223: Orem Corporation's current liabilities are $75,000, its

Q249: Merati Corporation has two manufacturing departments--Forming and

Q292: Which of the following is correct concerning

Q304: Fixed costs expressed on a per unit

Q380: Dallman Corporation uses a job-order costing system