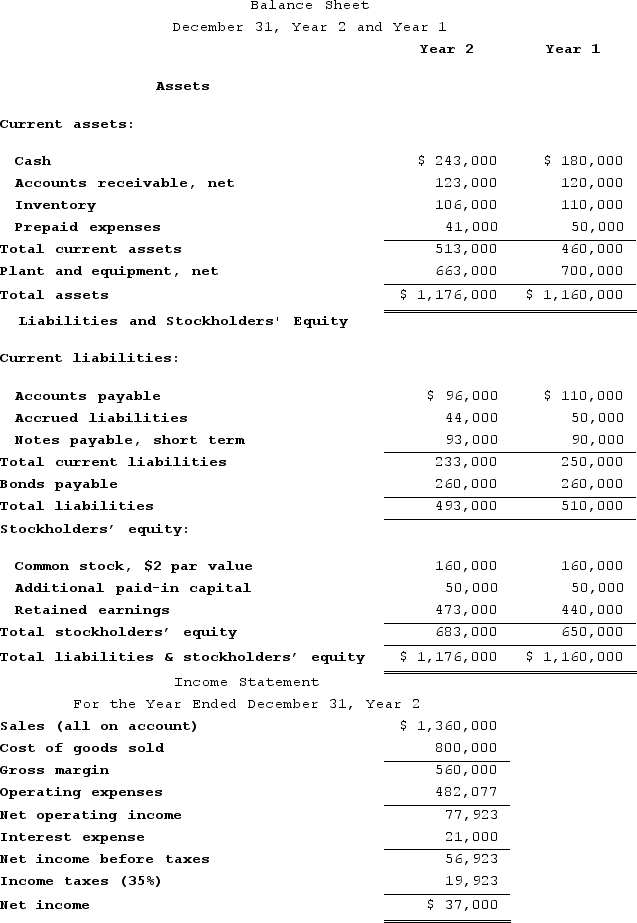

Kisselburg Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.Required:a. What is the company's working capital at the end of Year 2?b. What is the company's current ratio at the end of Year 2?c. What is the company's acid-test (quick) ratio at the end of Year 2?d. What is the company's accounts receivable turnover for Year 2?e. What is the company's average collection period for Year 2?f. What is the company's inventory turnover for Year 2?g. What is the company's average sale period for Year 2?h. What is the company's operating cycle for Year 2?i. What is the company's total asset turnover for Year 2?j. What is the company's times interest earned ratio for Year 2?k. What is the company's debt-to-equity ratio at the end of Year 2?l. What is the company's equity multiplier at the end of Year 2?m. What is the company's net profit margin percentage for Year 2?n. What is the company's gross margin percentage for Year 2?o. What is the company's return on total assets for Year 2?p. What is the company's return on equity for Year 2?q. What is the company's earnings per share for Year 2?r. What is the company's price-earnings ratio for Year 2?s. What is the company's dividend payout ratio for Year 2?t. What is the company's dividend yield ratio for Year 2?u. What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.Required:a. What is the company's working capital at the end of Year 2?b. What is the company's current ratio at the end of Year 2?c. What is the company's acid-test (quick) ratio at the end of Year 2?d. What is the company's accounts receivable turnover for Year 2?e. What is the company's average collection period for Year 2?f. What is the company's inventory turnover for Year 2?g. What is the company's average sale period for Year 2?h. What is the company's operating cycle for Year 2?i. What is the company's total asset turnover for Year 2?j. What is the company's times interest earned ratio for Year 2?k. What is the company's debt-to-equity ratio at the end of Year 2?l. What is the company's equity multiplier at the end of Year 2?m. What is the company's net profit margin percentage for Year 2?n. What is the company's gross margin percentage for Year 2?o. What is the company's return on total assets for Year 2?p. What is the company's return on equity for Year 2?q. What is the company's earnings per share for Year 2?r. What is the company's price-earnings ratio for Year 2?s. What is the company's dividend payout ratio for Year 2?t. What is the company's dividend yield ratio for Year 2?u. What is the company's book value per share at the end of Year 2?

Definitions:

Independent Variable

In an experiment, the variable that is manipulated or altered by the researcher to observe its effect on the dependent variable.

Dependent Variable

The variable in a study that is expected to change in response to changes in the independent variable, often measured to assess the effect of a treatment.

Experimental Group

The group in an experiment that receives the treatment or condition being tested, as opposed to the control group.

Control Group

In scientific research, a group of subjects that does not receive the experimental treatment and is used as a baseline to compare the effects of the treatment.

Q24: Cash equivalents on the statement of cash

Q76: Bolka Corporation, a merchandising company, reported the

Q94: Wessner Corporation has provided the following information:

Q153: Mahoe Corporation has provided the following financial

Q153: The management of Opray Corporation is considering

Q168: Treads Corporation is considering the purchase of

Q205: An increase in the Inventory account from

Q290: Schonhardt Corporation's relevant range of activity is

Q337: Stockinger Corporation has provided the following information

Q400: Almendarez Corporation is considering the purchase of