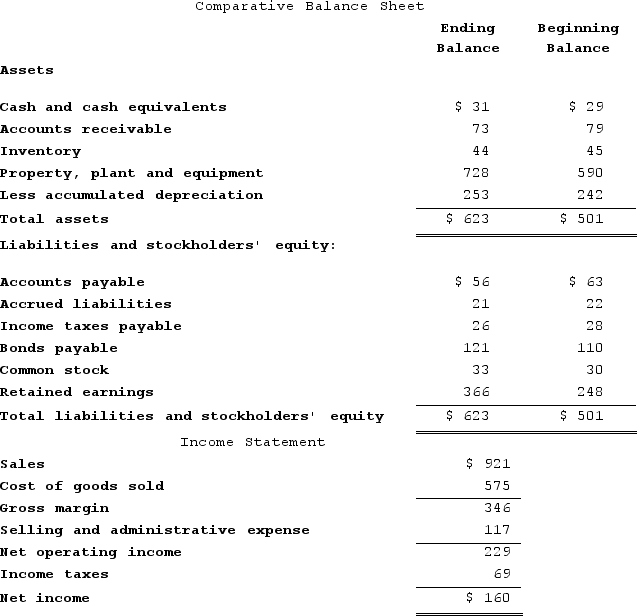

The most recent balance sheet and income statement of Oldaker Corporation appear below:  The company paid a cash dividend of $42 and it did not dispose of any property, plant, and equipment. The company did not retire any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) financing activities for the year was:

The company paid a cash dividend of $42 and it did not dispose of any property, plant, and equipment. The company did not retire any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) financing activities for the year was:

Definitions:

Factory Overhead

All indirect costs associated with manufacturing, excluding direct materials and direct labor. Also known as manufacturing overhead, this includes costs such as utilities, depreciation, and maintenance of equipment.

Direct Labor

Labor costs directly attributable to the production of goods, including wages paid to workers who are actively involved in the manufacturing process.

Direct Material

Raw materials that are directly traceable to the manufacturing of a product and constitute a significant portion of the production cost.

Variable Manufacturing Costs

Costs that vary in proportion to changes in the level of production, including direct materials, direct labor, and variable overhead.

Q10: The ending and beginning balances of Farmer

Q28: The changes in each balance sheet account

Q32: The formula for the return on equity

Q96: Shimko Corporation's most recent comparative balance sheet

Q122: All other things the same, if the

Q178: Oriental Corporation has gathered the following data

Q229: Mulford Corporation has provided the following information

Q249: Podratz Corporation has provided the following information

Q305: Financial statements for Narstad Corporation appear below:

Q387: The investment in working capital at the