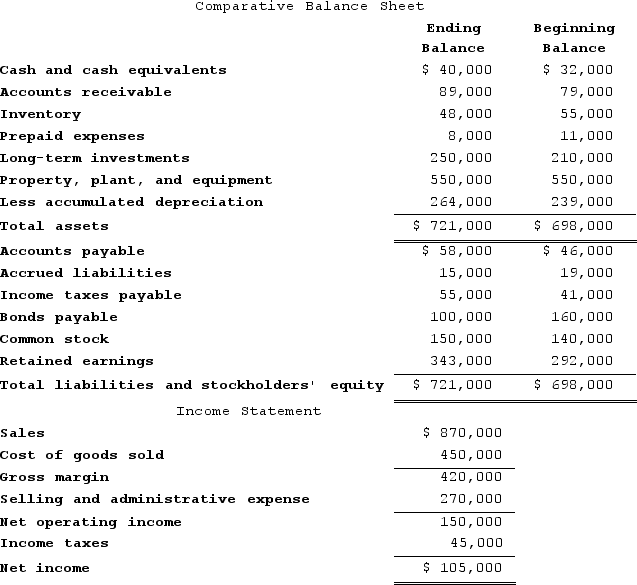

Walmouth Corporation's comparative balance sheet and income statement for last year appear below:  The company declared and paid a cash dividend of $54,000 during the year. It did not purchase or dispose of any property, plant, and equipment. It did not issue any bonds or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) operating activities last year was:

The company declared and paid a cash dividend of $54,000 during the year. It did not purchase or dispose of any property, plant, and equipment. It did not issue any bonds or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) operating activities last year was:

Definitions:

Patents

Legal documents granting exclusive rights to inventors for their innovations, preventing others from making, using, or selling the invention for a certain period of time.

Accounts Receivable

Money that is owed to a company by its customers for goods or services that have been delivered but not yet paid for.

Marginal Tax Rate

The rate at which the last dollar of a taxpayer's income is taxed, indicating the percentage of tax applied to their highest dollar of income.

Average Tax Rate

The proportion of total income that a taxpayer pays in taxes, calculated by dividing the total taxes paid by the total taxable income.

Q29: Prudencio Corporation has provided the following information

Q45: Inocencio Corporation has provided the following information

Q74: Falmouth Corporation's debt to equity ratio is

Q141: All other things the same, if long-term

Q148: Stepnoski Corporation is considering a capital budgeting

Q171: Krech Corporation's comparative balance sheet appears below:

Q198: Coache Corporation is considering a capital budgeting

Q245: Symons Corporation has provided the following financial

Q250: Spincic Corporation has provided the following data:

Q262: Which one of the following statements about