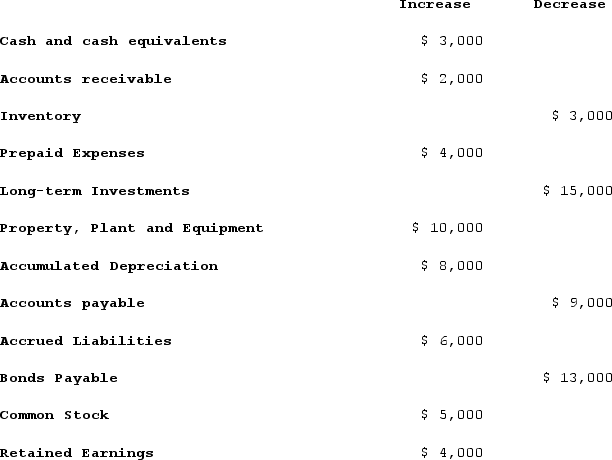

The change in each of Kendall Corporation's balance sheet accounts last year follows:  Kendall Corporation's income statement for the year was:

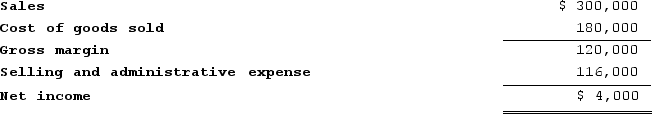

Kendall Corporation's income statement for the year was: There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.Using the direct method, sales adjusted to a cash basis would be:

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year. The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock. The net cash provided by (used in) operating activities on the statement of cash flows is determined using the direct method.Using the direct method, sales adjusted to a cash basis would be:

Definitions:

Reportable Segment Revenues

The revenues generated by each distinguishable segment of a company, as required to be disclosed in financial statements under certain accounting standards.

Revenue Test

An accounting principle used to determine when revenue should be recognized in the financial statements, typically requiring that revenue is earned and measurable.

Reportable Segments

Portions of a business that can be separately reported due to their significant activities, differing from other parts of the company, often requiring disclosure under financial regulations.

Interim Financial Statements

Financial reports covering a period shorter than a fiscal year, providing a view of a company's financial health in mid-year.

Q32: Kilduff Corporation's balance sheet and income statement

Q90: The cost of capital is the average

Q101: Dennisport Corporation has an acid-test ratio of

Q124: Correll Corporation is considering a capital budgeting

Q172: Oriental Corporation has gathered the following data

Q173: Burns Corporation's net income last year was

Q185: Ribaudo Corporation has provided the following financial

Q244: Tobia Corporation has provided the following financial

Q256: Galati Corporation has provided the following information

Q275: The times interest earned ratio of Whitney