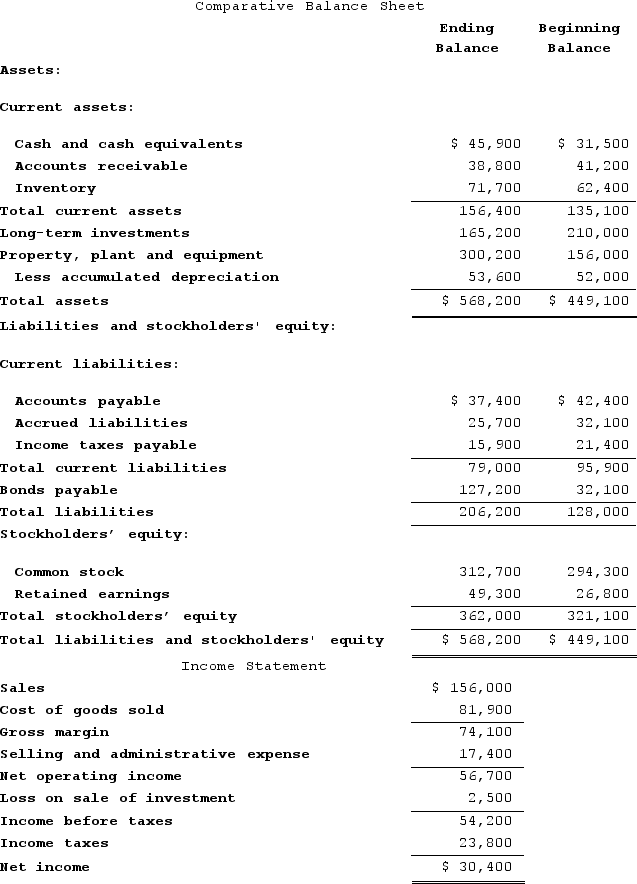

Comparative balance sheets and the income statements for Ellis Corporation are presented below:

The following additional information is available for the year:* During the year, the company sold long-term investments for $42,300 that had been purchased for $44,800.* The company did not sell any property, plant, and equipment during the year or repurchase any of its own common stock.* All sales were on credit.* The company paid a cash dividend of $7,900.* The company paid cash to retire $16,200 of bonds payable.

The following additional information is available for the year:* During the year, the company sold long-term investments for $42,300 that had been purchased for $44,800.* The company did not sell any property, plant, and equipment during the year or repurchase any of its own common stock.* All sales were on credit.* The company paid a cash dividend of $7,900.* The company paid cash to retire $16,200 of bonds payable.

Required:a. Using the indirect method, determine the net cash provided by (used in) operating activities.b. Using the direct method, determine the net cash provided by (used in) operating activities.c. Using the net cash provided by (used in) operating activities amount from either part a or b, prepare a statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.)

Definitions:

Relevant Range

The span within which the assumptions about fixed and variable cost behaviors are valid.

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Variable Costing

An accounting method that only includes variable production costs (materials, labor) in product cost, excluding fixed costs.

Mixed Cost

A cost that has both fixed and variable components, which changes with the level of output but not in direct proportion.

Q24: Cash equivalents on the statement of cash

Q65: Free cash flow is net cash provided

Q105: A company wants to have $40,000 at

Q113: Van Beeber Corporation's comparative balance sheet and

Q240: The management of Nixon Corporation is investigating

Q265: The management of Ro Corporation is investigating

Q301: Sperle Corporation has provided the following data

Q317: When a company is cash poor, a

Q365: A company with $500,000 in operating assets

Q402: Morefield Corporation has provided the following information