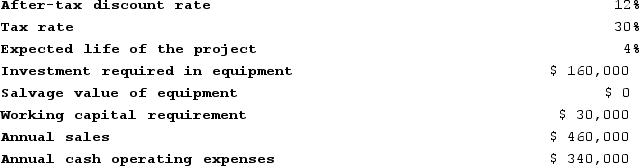

Waltermire Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

Definitions:

Shareholders

Individuals or entities that own shares in a corporation and therefore have a claim on part of the company's assets and earnings.

Going Private

The process by which a publicly traded company is transformed into a privately held entity.

Hostile Takeover

A takeover to which the management of the target corporation objects.

Leveraged Buyout

The acquisition of a company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition.

Q23: Duma Corporation has provided the following information

Q51: Walmouth Corporation's comparative balance sheet and income

Q81: Last year Burch Corporation's cash account decreased

Q88: The simple rate of return is computed

Q105: A company wants to have $40,000 at

Q113: Vandezande Incorporated is considering the acquisition of

Q259: Ostermeyer Corporation is considering a project that

Q264: Ouzts Corporation is considering Alternative A and

Q408: Sunk costs and future costs that do

Q417: The SP Corporation makes 33,000 motors to