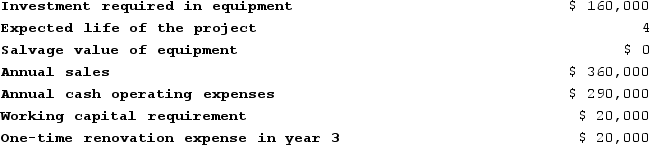

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

Definitions:

Interest Rate

The amount charged, expressed as a percentage of principal, by a lender to a borrower for the use of assets.

Future Value

The value of an asset at a specific date in the future, calculated from its present value using the expected rate of return.

Compounded Semiannually

Interest calculation method where interest is added to the principal amount twice a year, leading to interest on interest in the second half.

Simple Interest

Interest calculated on the principal amount of a loan or deposit, without compounding over time.

Q47: A new product, an automated crepe maker,

Q48: The most recent comparative balance sheet of

Q98: Ecob Corporation uses the absorption costing approach

Q111: The management of Woznick Corporation has been

Q128: Under the absorption approach to cost-plus pricing

Q132: Stone Retail Corporation's most recent comparative Balance

Q152: Tiff Corporation has provided the following data

Q215: Ahrends Corporation makes 70,000 units per year

Q326: Fixed costs may be relevant in a

Q373: In a factory operating at capacity, every