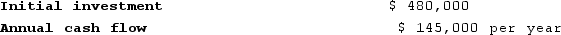

Puello Corporation has provided the following data concerning an investment project that it is considering:  Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.The life of the project is 4 years. The company's discount rate is 8%. The net present value of the project is closest to:

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.The life of the project is 4 years. The company's discount rate is 8%. The net present value of the project is closest to:

Definitions:

Bond Exchange

The process of trading bonds in the financial market, where investors buy and sell debt securities issued by entities like governments and corporations.

Market Rate of Interest

The prevailing rate of interest observed in the marketplace for loans and investments.

Trading

Buying and selling securities or commodities in financial markets, aiming for short-term profits.

Effective-Interest Method

A method of calculating the amortized cost of a bond and of interest expense over the bond's life, reflecting a constant rate of interest.

Q9: Groeneweg Corporation has provided the following data:

Q16: Donayre Corporation is considering a capital budgeting

Q49: Data from Dunshee Corporation's most recent balance

Q81: Remley Corporation has provided the following financial

Q88: The simple rate of return is computed

Q132: Excerpts from Sydner Corporation's most recent balance

Q151: When a company invests in equipment, it

Q233: An increase in the discount rate:<br>A) will

Q306: Shilt Corporation is considering a capital budgeting

Q386: Boynes Corporation is considering a capital budgeting