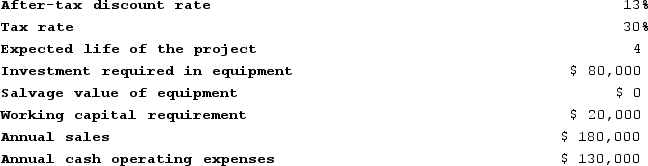

Mcelveen Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to:

Definitions:

Average Rate of Return

A financial ratio that represents the average net profit or return expected on an investment over its lifetime, expressed as a percentage.

Straight-Line Depreciation

A method of calculating the depreciation of an asset, dividing its cost minus salvage value by its useful life, resulting in equal annual depreciation expenses.

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment or project, calculating the difference between the present value of cash inflows and outflows.

Present Value Index

A calculation that compares the present value of cash inflows to the initial investment, often used in capital budgeting.

Q8: The internal rate of return method assumes

Q34: Magney, Incorporated, uses the absorption costing approach

Q67: Morrel University has a small shuttle bus

Q90: The markup over cost under the absorption

Q91: Buckley Corporation's most recent comparative balance sheet

Q162: Neither the net present value method nor

Q199: When discounted cash flow methods of capital

Q232: Joetz Corporation has gathered the following data

Q277: The management of Giammarino Corporation is considering

Q308: Schimpf Industries Incorporated has developed a new