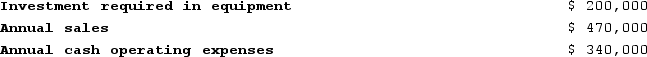

Chene Corporation has provided the following information concerning a capital budgeting project:  The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to:

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to:

Definitions:

Influential Company Contacts

Key individuals within a company who have significant influence over decisions and organizational directions.

Conflict Resolution

The methods and processes involved in facilitating the peaceful ending of conflict and retribution, often through negotiation, mediation, or dialogue among parties.

Collaborative Problem Solving

this method involves two or more individuals working together in a cooperative manner to solve a problem or achieve a goal.

Group Potency

The collective belief of a team in its own capability to succeed in a given task or project.

Q23: The management of Bonga Corporation is considering

Q90: The Warrel Corporation reported the following data

Q140: Discounted cash flow techniques automatically take into

Q158: Hayward Corporation had net sales of $610,000

Q167: Anthony operates a part time auto repair

Q196: Mulford Corporation has provided the following information

Q303: Gallerani Corporation has received a request for

Q316: Two alternatives, code-named X and Y, are

Q320: Ladle Corporation uses the absorption costing approach

Q353: Almendarez Corporation is considering the purchase of