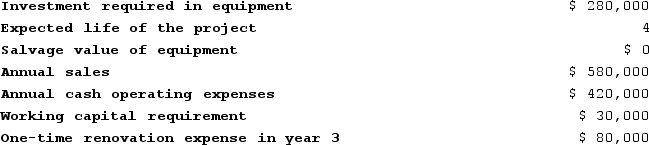

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

Definitions:

Belt-driven

Refers to a mechanism where a belt is used to transfer motion and power between pulleys or gears in various mechanical systems.

Hydraulic Pump

A device that converts mechanical energy and motion into hydraulic fluid power.

Gear Box

A casing containing the gears in a mechanical system, facilitating the transmission of power and allowing for speed/torque changes.

Center Link

A steering system component that connects the steering arms to the tie rods, enabling the wheels to turn.

Q20: If the salvage value of equipment at

Q20: Carson Corporation's comparative balance sheet and income

Q89: Under the direct method of determining the

Q106: The changes in Northrup Corporation's balance sheet

Q115: Annala Corporation is considering a capital budgeting

Q187: Under the indirect method of determining the

Q253: Bourland Corporation is considering a capital budgeting

Q279: Coffie Corporation has provided the following information

Q296: Prudencio Corporation has provided the following information

Q432: Hamby Corporation is preparing a bid for