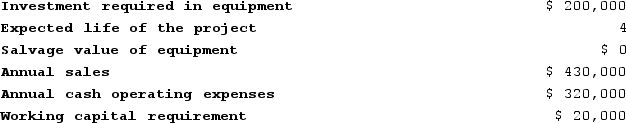

Reye Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

Definitions:

Pregnancy

The condition of having a developing embryo or fetus in the uterus, marked by various physical and hormonal changes.

Third Trimester

The final stage of pregnancy, spanning from week 28 to birth, characterized by significant fetal growth and bodily changes in preparation for childbirth.

Miscarriage

is the spontaneous loss of a pregnancy before the fetus is able to survive outside the womb, typically before 20 weeks of gestation.

Orgasm

A peak of sexual pleasure characterized by a series of rhythmic contractions of the genital organs, often accompanied by the ejaculation of semen in men and vaginal contractions in women.

Q39: One of the employees of Davenport Corporation

Q82: Megan Corporation's net income last year was

Q85: In the statement of cash flows, collecting

Q160: McCorey Corporation recorded the following events last

Q161: Cash payments to insurers and utility providers

Q187: The following data concern an investment project

Q205: Part U67 is used in one of

Q251: All other things equal including costs, if

Q380: Patenaude Corporation has provided the following information

Q396: The management of Hibert Corporation is considering