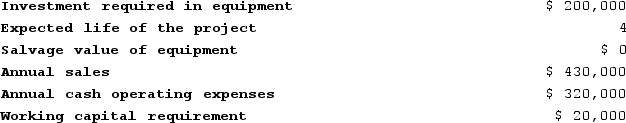

Reye Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

Definitions:

Sherman Act

A foundational antitrust law in the United States designed to prevent monopolistic practices and promote competition.

Competition

The rivalry among businesses to attract customers and gain market share, driving innovation, efficiency, and lower prices.

Service Industries

Sectors of the economy that provide intangible goods or services, such as healthcare, education, and finance.

American Firms

Companies or corporations that are registered and operate in the United States, contributing to its economy.

Q19: When a company has a production constraint,

Q99: Clayborn Corporation's net cash provided by operating

Q155: Under the direct method of determining the

Q194: Salsedo Corporation's balance sheet and income statement

Q201: Kinsley Corporation manufactures numerous products, one of

Q219: Dorris Corporation's balance sheet and income statement

Q248: Ouzts Corporation is considering Alternative A and

Q326: Paletta Corporation has provided the following information

Q346: Joanette, Incorporated, is considering the purchase of

Q424: Danny Dolittle makes crafts in his spare