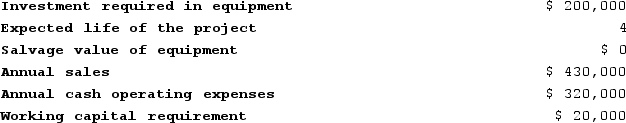

Reye Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

Definitions:

Maximize Revenue

The process of adjusting price levels, production quantities, and sales strategies to achieve the highest possible sales income.

Plain English Handbook

A guide aimed at promoting the use of clear, concise, and easily understood language in written communication.

Federal Plain Language Guidelines

A set of standards and recommendations aimed at making federal government publications clear, concise, and easy to understand for the general public.

Proofreading

The process of reading and correcting written material to ensure accuracy in grammar, spelling, and punctuation.

Q65: The present value of a given future

Q110: Paying wages and salaries to employees is

Q122: Whittenton Corporation manufactures numerous products, one of

Q160: Some investment projects require that a company

Q164: Two alternatives, code-named X and Y, are

Q202: Seamons Corporation has the following information available

Q203: Barbera Corporation has provided the following information

Q262: Hady Corporation is considering purchasing a machine

Q284: Basta Corporation has provided the following data

Q392: The management of Giammarino Corporation is considering