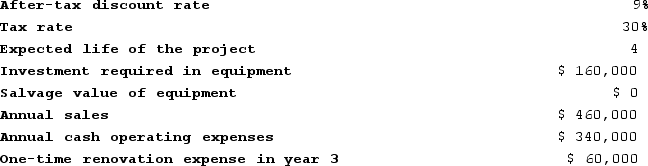

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the tables provided.The net present value of the entire project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the tables provided.The net present value of the entire project is closest to:

Definitions:

Relative Frequency

The ratio of the number of times a particular value occurs to the total number of occurrences.

Midpoint

The value exactly in the middle of a range, or the average of two numbers.

Hours Worked

The total time period that an employee spends performing tasks or duties for an employer during a given timeframe.

Statistics Students

Individuals who are engaged in learning about statistical methods, theories, and applications, often with the goal of applying this knowledge in various scientific, industrial, or social contexts.

Q3: Majorn Auto Parts Store had net income

Q39: Inocencio Corporation has provided the following information

Q68: Stockinger Corporation has provided the following information

Q106: The Jabba Corporation manufactures the "Snack Buster"

Q120: The following events occurred last year at

Q130: Slomkowski Corporation is contemplating purchasing equipment that

Q139: Frankin Corporation's net cash provided by operating

Q281: Decelle Corporation is considering a capital budgeting

Q310: How much would you have to invest

Q370: Bertucci Corporation makes three products that use