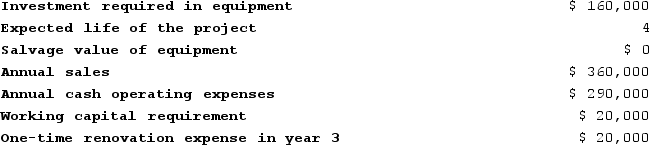

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

Definitions:

Reports Income

The process of declaring income received during a tax year on one's tax return.

Taxpayer

A person or organization required to remit taxes to governmental bodies at any level, including federal, state, or municipal.

Tax Liability

The amount of total tax debt owed by an individual or entity to the taxing authority, such as the IRS, after all deductions, credits, and exemptions.

Taxable Qualified Dividend

Dividends that meet certain criteria set by the IRS to be taxed at the lower long-term capital gains tax rates.

Q22: The data given below are from the

Q48: The management of Byrge Corporation is investigating

Q88: The simple rate of return is computed

Q182: Planas Corporation has provided the following information

Q212: Joetz Corporation has gathered the following data

Q261: Maurer Corporation is considering a capital budgeting

Q307: Strausberg Incorporated is considering investing in a

Q316: Two alternatives, code-named X and Y, are

Q336: Kneller Corporation manufactures and sells medals for

Q401: At an interest rate of 14%, approximately