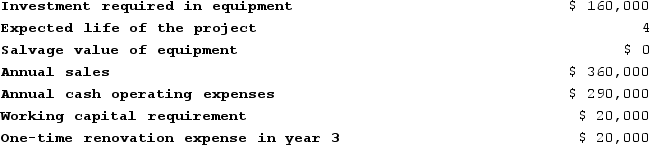

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

Definitions:

Intrinsic Value

The perceived or calculated true value of an asset, investment, or company based on fundamentals and independent of market price.

P/E Multiple

The price-to-earnings ratio, a valuation measure comparing the current price of a stock to its per-share earnings.

EPS

Earnings Per Share - a financial metric calculating the portion of a company's profit allocated to each outstanding share of common stock, indicating a company's profitability.

Intrinsic Value

The actual value of a company, asset, or currency, based on underlying perception of its true value including all aspects of the business.

Q2: Wary Corporation is considering the purchase of

Q57: Boe Corporation is investigating buying a small

Q83: Manjarrez Corporation has provided the following information

Q90: The markup over cost under the absorption

Q200: Comparative balance sheets and the income statements

Q209: Boggess Corporation manufactures numerous products, one of

Q294: Stinehelfer Beet Processors, Incorporated, processes sugar beets

Q332: Last year the sales at Summit Corporation

Q386: When a company has a production constraint,

Q429: Costs associated with two alternatives, code-named Q