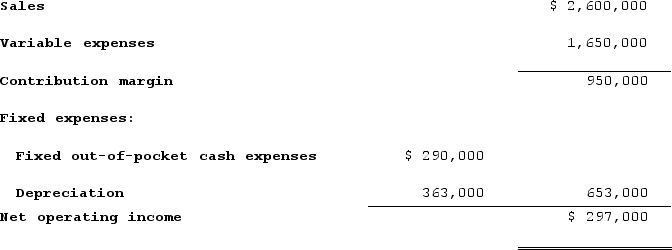

Ursus, Incorporated, is considering a project that would have a eight-year life and would require a $2,904,000 investment in equipment. At the end of eight years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.):

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%.Required:a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.)

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%.Required:a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.)

b. Compute the project's internal rate of return. (Round your final answer to the nearest whole percent.)

c. Compute the project's payback period. (Round your answer to 2 decimal place.)

d. Compute the project's simple rate of return. (Round your final answer to the nearest whole percent.)

Definitions:

Type I Error

A statistical error occurring when a true null hypothesis is incorrectly rejected.

Significance Level

The significance level, often denoted by alpha, is the probability of rejecting the null hypothesis when it is true, utilized in hypothesis testing as a threshold for determining statistical significance.

Type I Error

The mistake of rejecting the null hypothesis when it is actually true, often represented by the symbol α.

Rejection Region

The range of values in hypothesis testing for which the null hypothesis is rejected, based on the chosen level of significance.

Q13: Cridberg Corporation's selling and administrative expenses for

Q69: Maurer Corporation is considering a capital budgeting

Q77: Future costs that do not differ between

Q122: Whittenton Corporation manufactures numerous products, one of

Q129: Mercer Corporation estimates that an investment of

Q146: Winder Corporation is a specialty component manufacturer

Q147: The Melville Corporation produces a single product

Q164: A capital budgeting project's incremental net income

Q286: Dobrinski Corporation has provided the following information

Q363: Drew Cane Products, Incorporated, processes sugar cane