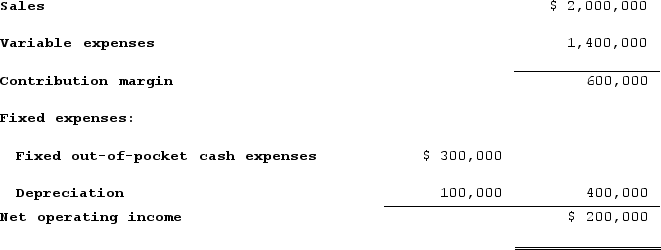

Ursus, Incorporated, is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.):

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:a. Compute the project's net present value.b. Compute the project's internal rate of return to the nearest whole percent.c. Compute the project's payback period.d. Compute the project's simple rate of return.

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:a. Compute the project's net present value.b. Compute the project's internal rate of return to the nearest whole percent.c. Compute the project's payback period.d. Compute the project's simple rate of return.

Definitions:

Exchange Rate

The worth of one currency relative to another, used to determine the amount of one currency that can be swapped for a different one.

Japanese Yen

The official currency of Japan, often symbolized as ¥ and known for being one of the most traded currencies in the foreign exchange market.

U.S. Dollar

The official currency of the United States, widely used as a standard currency in international markets.

Foreign Exchange Market

A global marketplace for exchanging national currencies against one another.

Q74: Last year Lawn Corporation reported sales of

Q79: The change in each of Kendall Corporation's

Q112: Manila Corporation's comparative balance sheet appears below:<br>

Q118: Kahn Corporation (a multi-product company) produces and

Q194: If the internal rate of return is

Q255: Bertucci Corporation makes three products that use

Q312: Landor Appliance Corporation makes and sells electric

Q364: A project has an initial investment of

Q365: A company with $500,000 in operating assets

Q397: The management of Elamin Corporation is considering