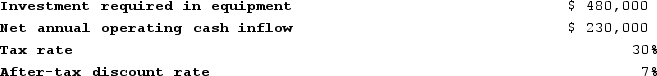

Rapozo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Definitions:

Q35: Crowl Corporation is investigating automating a process

Q40: Nakama Corporation is considering investing in a

Q48: The most recent comparative balance sheet of

Q54: Kinsley Corporation manufactures numerous products, one of

Q95: Information on four investment proposals is given

Q165: Morice Industries Incorporated has developed a new

Q188: Russnak Corporation is investigating automating a process

Q252: Facio Corporation has provided the following data

Q308: Schimpf Industries Incorporated has developed a new

Q373: A company has unlimited funds to invest