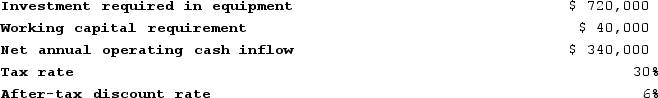

Padmore Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Definitions:

Interest-bearing Debt

A type of debt that incurs interest expenses over the loan period.

IFRS Rules

Specific guidelines and standards set out by the International Financial Reporting Standards to govern how financial transactions and positions should be reported in the financial statements.

Impairment Losses

Financial losses recognized when an asset's carrying value exceeds its recoverable amount.

GAAP

Generally Accepted Accounting Principles (GAAP) are a framework of accounting standards, procedures, and rules used by accountants to prepare financial statements in the United States.

Q18: "Trueba Electronics Corporation" has developed a new

Q124: Dock Corporation makes two products from a

Q126: Highpoint, Incorporated, is considering investing in automated

Q147: Financial statements of Rukavina Corporation follow: <img

Q164: A capital budgeting project's incremental net income

Q208: Fast Food, Incorporated, has purchased a new

Q312: Landor Appliance Corporation makes and sells electric

Q367: Denny Corporation is considering replacing a technologically

Q372: Parks Corporation is considering an investment proposal

Q387: Starowicz Corporation manufactures numerous products, one of