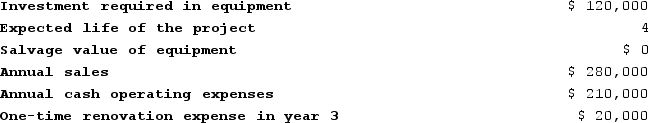

Newfield Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 13%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 13%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

Definitions:

Confounds

Variables that obscure the clear understanding of the relationship between different variables in a study, due to their intertwined effects.

Dependent Variable

In scientific research, the variable that is measured to see how it is affected by changes in another variable (the independent variable).

Independent Variable

In research, this is the variable that is manipulated or changed to observe its effect on a dependent variable.

Independent Variable

In research, the variable that is manipulated or changed to observe its effect on a dependent variable.

Q27: The balanced scorecard can only have four

Q35: The four categories of quality costs in

Q37: Ladle Corporation uses the absorption costing approach

Q54: A company wants to have $20,000 at

Q118: Kahn Corporation (a multi-product company) produces and

Q143: Last year the sales at Summit Corporation

Q215: Dunstan Corporation is considering a capital budgeting

Q265: Schickel Incorporated regularly uses material B39U and

Q311: Boxton Corporation's required rate of return is

Q330: Farrugia Corporation produces two intermediate products, A