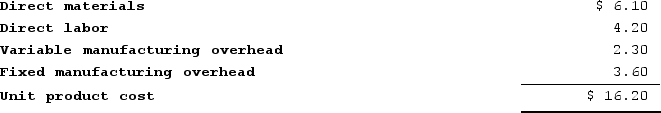

Gallerani Corporation has received a request for a special order of 6,000 units of product A90 for $21.20 each. Product A90's unit product cost is $16.20, determined as follows:  Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Definitions:

Dividends

Payments made by a corporation to its shareholder members, usually derived from the company's profits.

Backlog

Orders that have been received but not delivered to the customer.

Orders Received

The total number of orders that a company gets from its customers within a certain period.

Long-Term Investments

Assets that are more than 1 year old and are carried on the balance sheet at cost or book value with no appreciation.

Q32: Decelle Corporation is considering a capital budgeting

Q48: The management of Byrge Corporation is investigating

Q70: Consistency demands that a cost that is

Q175: Hinger Corporation is considering a capital budgeting

Q192: The management of Byrge Corporation is investigating

Q213: Hinger Corporation is considering a capital budgeting

Q232: Joetz Corporation has gathered the following data

Q362: Houze Corporation has provided the following information

Q392: The management of Giammarino Corporation is considering

Q430: Ritner Corporation manufactures a product that has