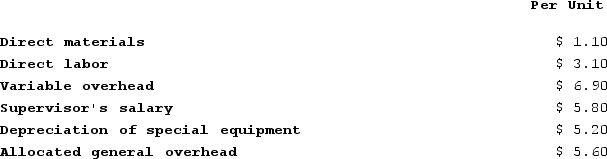

Penagos Corporation is presently making part Z43 that is used in one of its products. A total of 5,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided.In addition to the facts given above, assume that the space used to produce part Z43 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the annual financial advantage (disadvantage) of buying part Z43 from the outside supplier and using the freed space to make more of the other product?

An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided.In addition to the facts given above, assume that the space used to produce part Z43 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the annual financial advantage (disadvantage) of buying part Z43 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Interest Rate

The amount charged by a lender to a borrower for the use of assets, expressed as a percentage of the principal, typically noted on an annual basis.

Direct Write-off Method

An accounting practice where uncollectible accounts receivables are written off directly against income at the time they are deemed noncollectable.

Allowance Method

An accounting technique used to account for bad debts, which estimates and sets aside a portion of accounts receivable deemed unlikely to be collected.

Uncollectible Receivables

Debts owed to a company that are considered to be uncollectable, indicating that the company does not expect to receive payment due to the debtor's inability to pay.

Q10: Perwin Corporation estimates that an investment of

Q29: Pankey Incorporated has a $700,000 investment opportunity

Q78: Quamma Corporation makes a product that has

Q109: Cannula Vending Corporation is expanding operations and

Q115: Kingcade Corporation keeps careful track of the

Q123: Bungert Incorporated reported the following results from

Q196: Which of the following would be considered

Q304: An advantage of using return on investment

Q310: How much would you have to invest

Q364: A project has an initial investment of