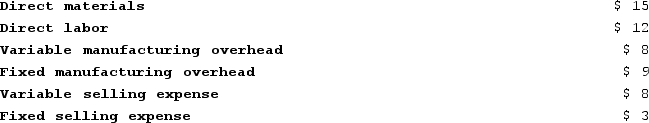

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:  The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. At what selling price for the 6,000 special order units would Melville be financially indifferent between accepting or rejecting the special order from Mowen?

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. At what selling price for the 6,000 special order units would Melville be financially indifferent between accepting or rejecting the special order from Mowen?

Definitions:

Earnings Per Share

A company's net profit divided by the number of its outstanding shares, indicating the profitability per share.

Merger Premium

The additional amount an acquirer pays over the current market price of a target company's shares during a merger or acquisition.

Market Price

The price at this moment for buying or selling an asset or service.

Q3: Marvel Corporation estimates that the following costs

Q19: Whenever the selling division must give up

Q33: Saalfrank Corporation is considering two alternatives that

Q37: A company needs an increase in working

Q42: Fackler Company's quality cost report is to

Q75: Corporate social responsibility performance reports are also

Q122: Net profit margin percentage is an example

Q148: Stepnoski Corporation is considering a capital budgeting

Q282: A disadvantage of vertical integration is that

Q294: Paragas, Incorporated, is considering the purchase of