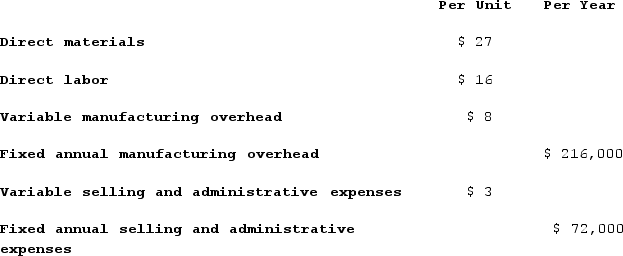

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:

Definitions:

Sell or Process Further

A decision-making process in cost accounting where a company must determine whether to sell a product as is or continue processing to add value.

Annual Rate of Return

The percentage return on an investment over a one-year period, encompassing both capital gains and interest payments.

Expected Annual Net Income

The projection of a company's net income over a year, taking into account estimated revenues and expenses.

Average Investment

The middle amount invested over a period of time, often used in performance measurement or investment appraisal.

Q22: Two alternatives, code-named X and Y, are

Q29: Pankey Incorporated has a $700,000 investment opportunity

Q106: In classifying the costs of quality at

Q109: The Wester Corporation produces three products with

Q118: Kahn Corporation (a multi-product company) produces and

Q133: The corporate social responsibility measure of "Total

Q175: It is profitable to continue processing joint

Q286: Dobrinski Corporation has provided the following information

Q353: Jaakola Corporation makes a product with the

Q403: The Tolar Corporation has 400 obsolete desk